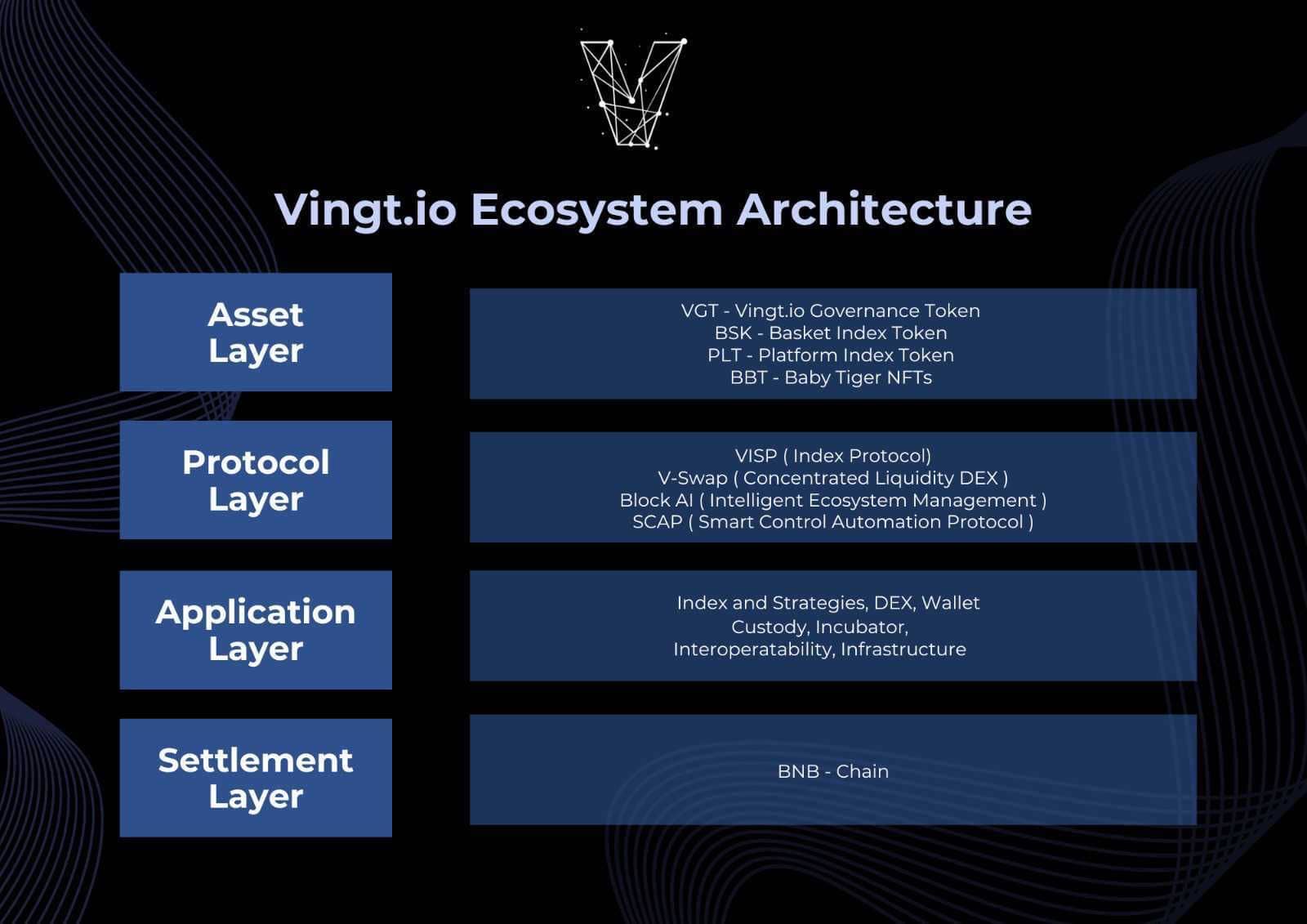

Index and Strategies

Financial products common to credit and equity markets are missing in the crypto space. For example, there is no product equivalent to global market indices such as Itraxx and S&P500. Vingt.io will include cryptocurrency indices like the products available in conventional financial markets.

VISP - A tokenized index platform

Vingt.io has created VISP, as an open source platform for entrepreneurs and fund managers to create their own strategies and indexes in a tokenized BEP-20 form.

Asset management on VISP

Through VISP, anyone can pass a single transaction and create their own digital asset index. The underlying assets associated with each token set are held on-chain in its smart contract and traded on DEXs for rebalancing using VISP modules. The manager of every token set is responsible for initiating trades during this rebalancing phase. Through a DelegatedManger system the responsibility of a manger could be further delegated to multiple stake holders for maintaining a token set.

Burning and Minting of Token Sets

Users holding underlying assets of a particular index in the right ratio can purchase/swap these assets using the Basic Issuance Module of VISP that would hold the assets within the protocol and issue tokens accordingly. If the user wants to sell tokens directly through the protocol, they would receive the underlying assets in their non-custodial wallet. All of these transactions will be securely processed on-chain.

If an index strategy is able to gain user adoption for its set token, it could also be made available in secondary markets such as DEXs and CEXs for direct transaction pairs. For all purposes, every token corresponding to an index strategy is a BEP-20 token and can be listed on all exchanges.

BSK - Basket Token

The first project under this category is the ‘BSK’ – Basket token that serves as a macro representation of the crypto market in the form of a basket of 4 premier tokens while acting as a hedge to market fluctuations.

BSK, Basket Index Token, is fully collateralized on-chain where all the underlying assets are held within the smart contract. BSK is a dynamic pool based on selection driver by periodic reviews. BSK token would be limited to 4 key cryptocurrencies for a relatively safer alternative. This would allow investors to get access to a macro position in the crypto market without having the need to buy multiple assets across multiple platforms as well as provide a degree of cover against the bear market.

Decentralized Exchange

Decentralized Exchanges are the backbone of DeFi ecosystem. In order to operate on-chain trades and for protocols for function independently, it is absolutely essential to integrate DEXs to get a completely decentralized experience. DEXs remove third parties from digital asset transactions. Currently BNB-chain is highly dependent on PancakeSwap v2 and v3 for on-chain transactions. Uniswap v3 has also launched on BNB-chain but has unable to carve out a substantial market share. These exchanges are using a generic User Interface, limiting the trade experience for users and charging higher fees, failing to optimize concentrated liquidity provided by the LP’s.

In conventional DEX's liquidity is spread from 0 to infinity and because of that, most of the liquidity provided by the LP token holders is not utilized. The token pairs end up trading only within a particular range because of which there is more slippage in transactions and liquidity providers earn less fees. Vingt.io is creating VingtSwap v3 DEX on BNB Chain that takes advantage of concentrated liquidity created a win-win situation for liquidity providers as well as traders. LP token holders are able to manage the price range where most of the trading takes place for a particular token pair; providing more liquidity, earning more transaction fee and giving better prices to traders.

Vingt.io Wallet

Vingt.io wallet is a non-custodial wallet used to hold, swap and transfer assets on EVM based L1-blockchains, providing web3.0 compatibility as browser extension. The main purpose of a non-custody wallet is to provide its users with security, capability, anonymity and decentralization. Investor expectations for digital asset management revolves around ensuring that the digital assets they hold are safe, accessible and easily convertible.

Security Features

With a non-custodial wallet, users are the only one having control of their private keys. This means the users are solely responsible to store their private keys in a safe and secure manner. Whoever controls the private keys, controls the funds. It gives users complete control of their funds and therefore they do not need to trust a third party for fund management. Since the private key is stored with the users and not online, it virtually becomes impossible to hack someone's account.

These advantages however, do come with some consequences. These non-custodial wallets do no come with backup facilities. If a user loses their private keys there would be no way to recover funds and these funds would become inaccessible permanently. All transactions on non-custodial wallets are on the blockchain which means that these transactions are taking place in real time and therefore transaction fees is paid to execute each transaction in the form of gas fees. If private keys are stored on a device, such as a desktop, the security of wallet keys could be compromised by a third party access to that device and Vingt.io would not be responisble was any mismanagement of private keys by the users.

Accessibility

Like any other non-custodial wallet, Vingt.io wallet would not have any sort of KYC and anyone can access a wallet regardless of their location, as long as they securely hold their private keys. This means that no information would be required from anyone in order to create a new wallet with Vingt.io. To ensure data privacy and security, it is recommended that the users interact only with legitimate websites when using Web3.0 compatibility to protect fund from external third party access.

The most common reservation against non custodial wallets is their rigid nature and the lack of multi-chain adaptability. Investors must create and maintain multiple wallets to house their respective portfolios, along with safeguarding multiple private keys. While certain non-custodial wallets allow multi chain functionality, this comes with limited display functionality and poor U/I (User Interface). Custodial exchange wallets on the other hand do allow better visibility but come at the expense of lack of control and vulnerability of the exchange itself.

Vingt.io wallet is an EVM based non-custodial wallet, specifically for BNB-Chain, that is simple to use and allows it users to view all their assets in one place. This would allow users to interact with decentralized applications using Web3.0 technology. Vingt.io Wallet aims to provides its users, the ease of use of an exchange wallet with the security of a non-custodial wallet.

Easily Convertible

Vingt.io wallet allow users to swap tokens directly from their wallet. These token swaps allow users to execute transactions through multiple aggregators and DEXs to ensure users always get the best price with the lowest network fees. DEXs are the main driving force that enables non-custodial swaps in a secure environment, however due to insufficient liquidity with some of the less popular tokens it gets difficult for users to trade at the best available price. This is why Vingt.io wallet links multiple DEXs to get the best price for its users.

Digital Ownership

Vingt.io Governance Token (VGT)

VGT is the BEP-20 Governance token for Vingt.io Ecosystem. This is the building block for decentralized management of Vingt.io Ecosystem. DeFi protocols of Vingt.io ecosystem are governed and operated by VGT.

NFTs

Baby Tiger is a series of digital art designed by Vingt.io consisting of 8888 unique images with various accessories. These ERC-721 tokens on Polygon Network are ecosystem memberships and are available on OpenSea.

Custodial Services

Vingt.io is providing custodial services for holding crypto assets for investors. Cryptocurrency investors have a problem holding crypto assets on a long-term basis because of different blockchains, unsafe hardware wallets and other crypto management lapses. Vingt.io is providing a comprehensive solution as a decentralized custodian of digital assets.

Vingt.io is creating a protocol of smart contracts for custody of digital assets in the form of digital vaults. These unowned and non upgradeable digital vaults would hold assets for customers on-chain in a decentralized manner.

Types of Custodial Services

Vingt.io is offering two different types of decentralized custodial services to the investors.

Fully Decentralized Custodial Services

"Not your keys, not your coins" is a popular statement with digital asset custody services. Investors who want to hold their private keys themselves could take advantage of this service. They could interact directly with smart contracts that hold digital assets to deposit and withdraw their funds through Web3.0 self-custody decentralized wallets. It is important for users to safely manage the private seed of their wallet used to interact with Vingt.io custodial service vault. In case the wallet access is lost by the users their would be no possible way to regain access to the permanently lost funds. As this decentralized service is available on-chain, the transactions would be visible on the blockchain/blockexplorer.

Joint Custodial Service

Users could also opt for joint custodial service where multiple on-chain wallet signatures are required to access the custodial service vault. In this case, the user and Vingt.io custodial service have joint access to funds stored within the smart contract and would not be accessible individually. All transactions would be available on the blockchain/blockexplorer.

Incubator

The cryptocurrency market is growing exponentially but the avenues available for blockchain developers are limited. Great blockchain ideas are unable to materialise because of limited resources and no direct access to the market. Initial offering solutions available in the crypto market today, operate within a limited capacity. Vingt.io is providing a launchpad for new tokens with innovative use cases, having the potential to create an impact in the crypto space.

Unlike other launchpads which are only limited to exchange listings, Vingt.io would provide complete assistance for developers to form a unique blockchain product, suitable for market adoption. These new third-party projects would increase the utility of VGT governance token and become part of the vingt.io ecosystem.

Interoperability

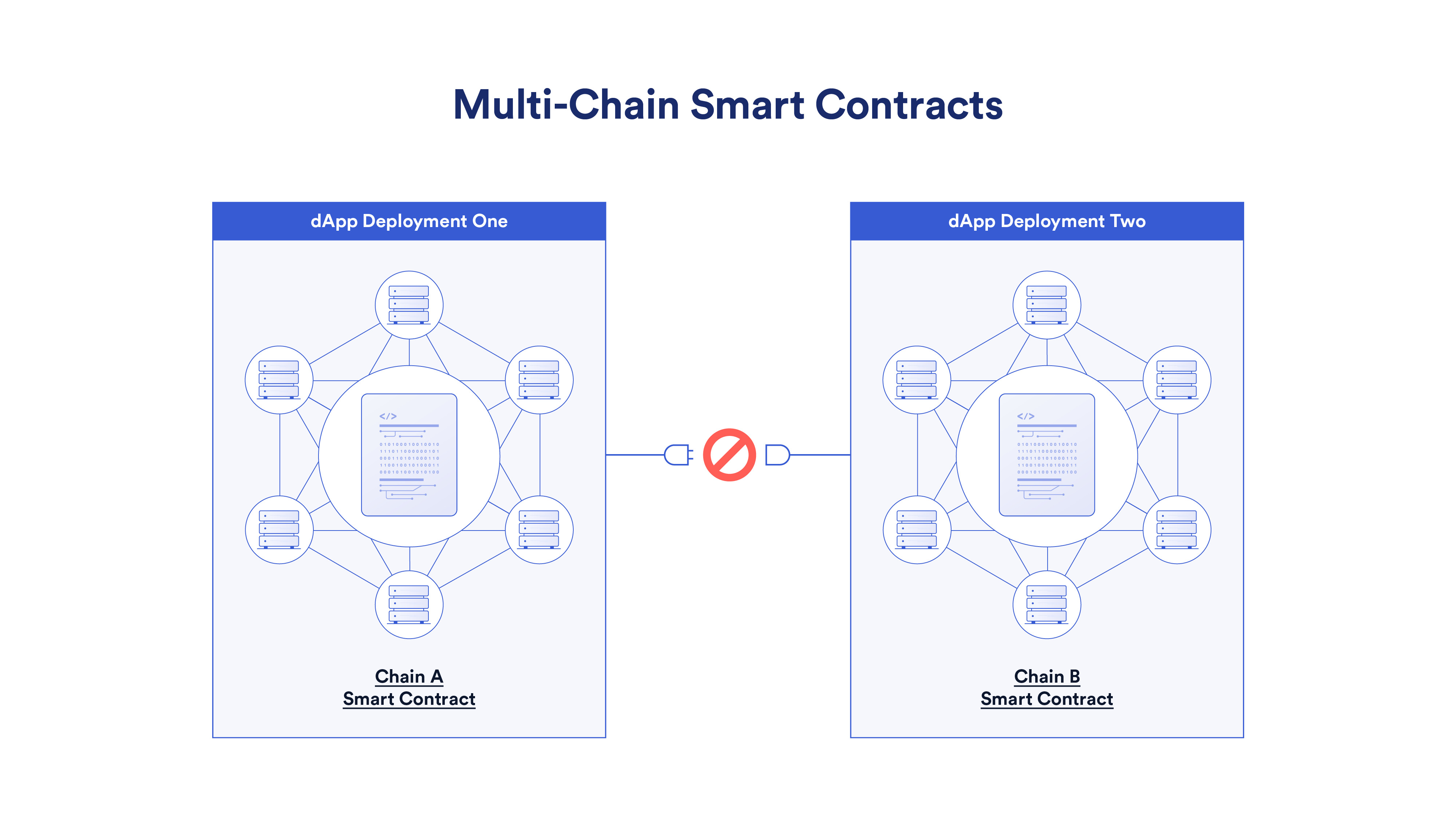

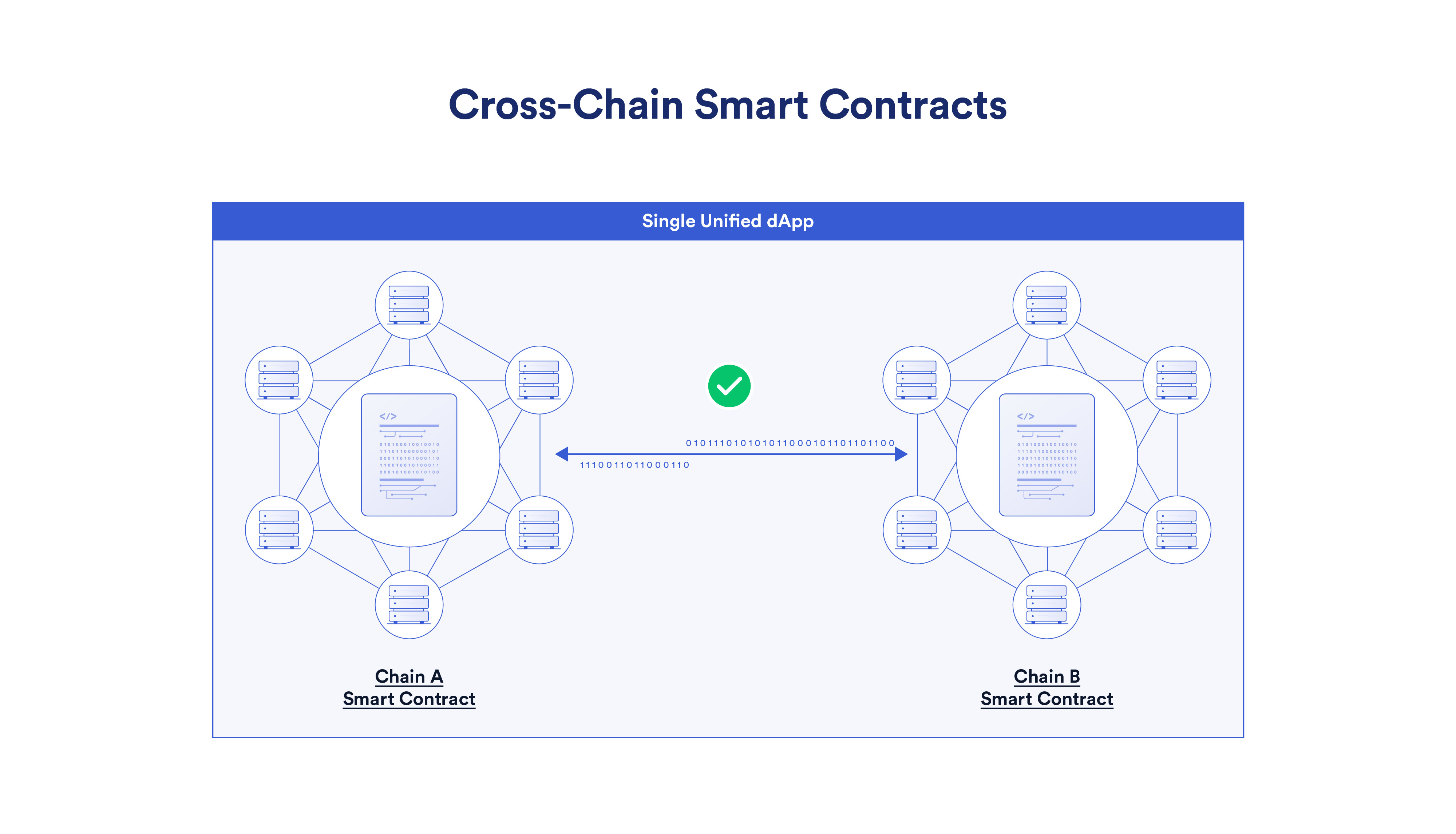

Cross-chain interoperability enables different blockchains to communicate with each other, giving smart contracts the ability to read and write data to and from other blockchains via cross-chain transactions. A cross-chain protocol can be used to facilitates this communication. Blockchains are not natively capable of communicating with each other. This makes blockchain interoperability vital in order to realize the full potential of a multi-chain ecosystem. With so much economic activity restricted on isolated networks, the need for cross-chain interoperability is becoming necessary for this industry.

Cross Chain Smart Contracts

Cross-chain smart contracts are applications made up of multiple smart contracts deployed across multiple blockchain networks, creating a single decentralized application. Cross-chain smart contracts are decentralized applications that are composed of multiple different smart contracts deployed across multiple different blockchain networks that interoperate to create a single unified application. This new design paradigm is a key step in the evolution of the multi-chain ecosystem and has the potential to create entirely new categories of smart contract use cases that leverage the unique benefits of different blockchains.

High demand for Ethereum smart contracts has led to an increase in network transaction fees over time. This has increased adoption of smart contracts and higher DeFi TVL on alternative blockchains. Smart contracts are deployed across multiple chains for a larger user base.

Multichain Challenges

• Lack of interoperability between blockchains• isolated liquidity on blockchains

• dealing with multiple U/I

• token bridges vulnerable to hacks and not fully compataible

Cross Chain Use Cases

• Cross chain exchange• Cross chain yield aggregation

• Cross chain lending

• Cross-Chain DAOs and NFTs

Secure Cross Chain Interoperability on Vingt.io Ecosystem

Vast majority of blockchain networks are unable to directly send and receive data between different blockchain networks. In order to support cross-chain smart contracts, additional infrastructure is required to enable cross-chain communication.

In comparison to traditional cross-chain bridges, Vingt.io aims to enable smart contracts to send both data and/or tokens across any blockchain in a secure manner. Data messages can be encoded/decoded by smart contracts in any manner, supporting a wide degree of flexibility in how they are interpreted.

In addition to a high-quality codebase, this protocol is planned to be further secured through an innovative risk management system called the Anti-Fraud Network. The Anti-Fraud Network is composed of independent committees of nodes, separate from those of facilitating the cross chain transition, with the sole purpose of malicious activity and blockchain network conditions. This additional verification layer can initiate the emergency shutdown of bridges, which pause the transfer of data and tokens temporarily to help protect cross-chain smart contracts and users against potential black swan events.

In addition to providing the infrastructure for creating cross-chain smart contracts, Vingt.io would also support the creation of various cross-chain token bridges, allowing users to directly bridge their tokens to different blockchains alongside commands on how to deploy such tokens.

Infrastructure

Vingt.io is building blockchain infrastructure development protocols to automate the entire ecosystem in facilitating transactions. Vingt.io is building blockchain infrastructure development protocols to automate the entire ecosystem in facilitating transactions.

SCAP

Vingt.io is revolutionizing smart contracts using transaction execution service. Smart Contract Automation Protocol (SCAP) is a unique auto-executing smart contract protocol which empower faster, more innovative and ground breaking applications. SCAP enables developers to trigger smart contract functionalities in an automated way.

Block-AI

"Vingt.io is bringing Artificial Intelligence (AI) to DeFi. Block-AI is an AI based DeFi Ecosystem management protocol that generates new outputs based on the data they have been trained on. This protocol is fine-tuned with both supervised and reinforced learning techniques and uses human trainers with different scenarios to generate ranked response through Generative AI.

Block-AI acts as an intelligent operator, connecting different decentralized products. This includes taking effective decisions on DEXs and risk management of the entire ecosystem. Generative AI allows this technology to modify and upgrade itself according to the environment in which it operates.